Let's Connect

Stay current on the latest reports and industry insights with our Newsletter.

By entering your information you agree to receive marketing emails from the GTDC.

Technology is now synonymous with business solutions. Organizations are effectively doubling down on computer and network investments to improve their operational flexibility and reduce the potential risks of future unknowns. In times of uncertainty, IT is a strong asset.

The numbers validate that hypothesis. The consistently positive sales trends in North America and European markets speak to the rising value of technology in the workplace and society, and the 2021 results are no exception. Despite ongoing COVID-19 restrictions and mandates and supply chain concerns across the globe, as well as new regulatory compliance and industry standards requirements in some regions, the IT industry is resilient.

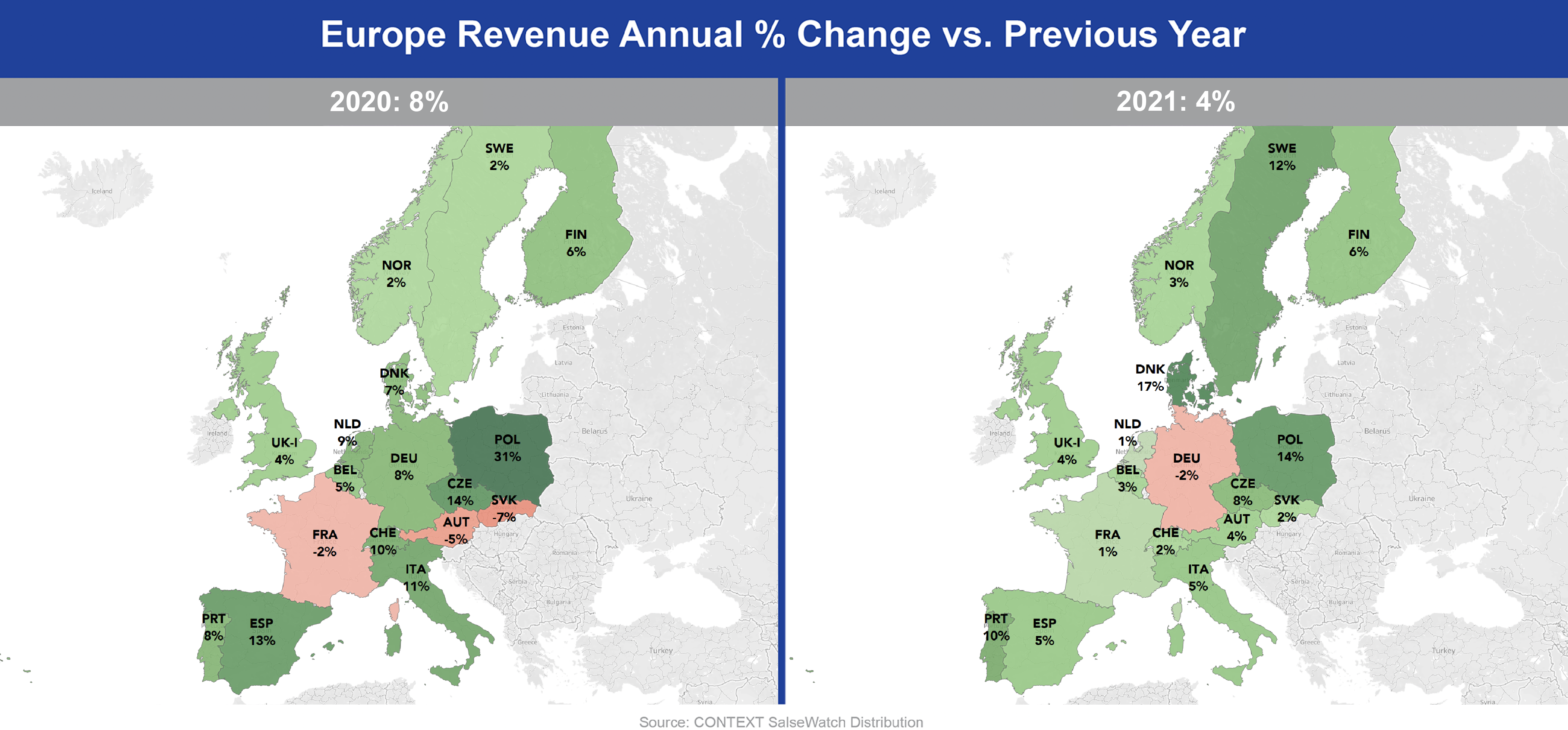

The European marketplace is a good starting point. While IT distribution revenue in the region rose 4% in 2021, those numbers don’t tell the full story. December set a monthly sales record (9.8 billion Euros), and annual revenue hit its highest point ever (87.9 billion Euros). An even more remarkable figure was a 12% two-year increase in revenue from 2019 to 2021 − especially considering the ongoing pandemic, supply chain challenges and chip shortage issues.

The consensus among distribution executives is those positive trends should continue in 2022. Much of that optimism relies on the return towards normalcy with chip production and hardware manufacturing to fulfill underlying demand. Resolving the supply chain issues of the past two years should help restore business and consumer confidence and drive additional orders.

Several countries experienced phenomenal growth in 2021, with Poland leading the way at 15% − after a 31% increase in 2020! Some of the other consistently positive sales performers over the past two years include Switzerland, Portugal, the Czech Republic, Finland, Spain and Italy.

Top Product Growth Categories in Europe for 2021

• Displays and TVs +14%

• Accessories +9%

• Smart Home/ Wearables +9%

• Components +9%

• Notebooks +7% following a 31% increase in 2020!

• Data Center and All Networking +6%

• Tablets +5% following a 23% increase in 2020!

• AV & Electronics +4% following a 26% increase in 2020!

Source: CONTEXT SalesWatch Distribution

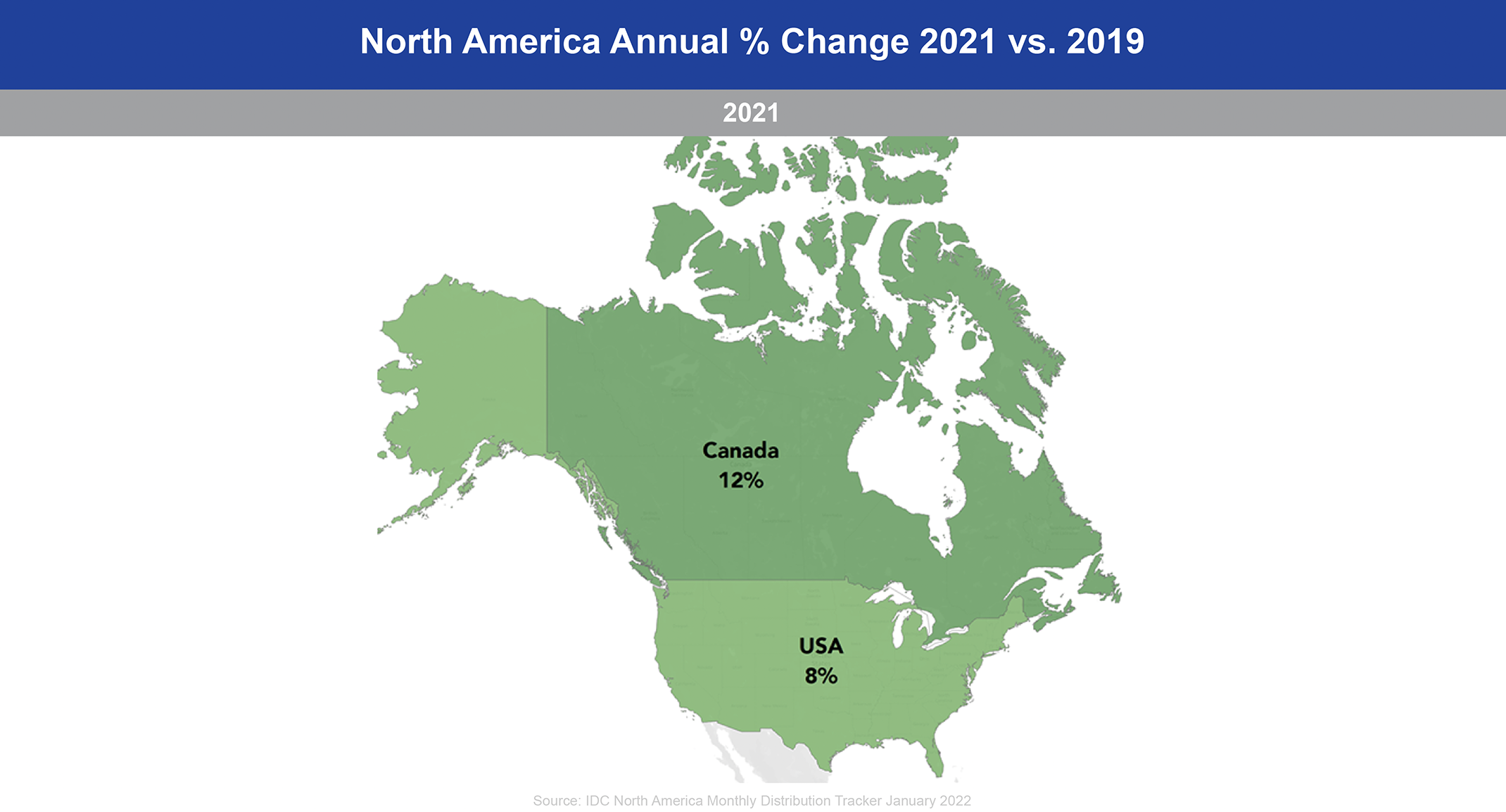

While European markets experienced a bit of a sales “ebb and flow” over the past two years, influenced in at least some part by government mandates and supply chain concerns, North American sales were somewhat reversed. Total revenue grew 8% in the U.S. and 12% in Canada over the past two years − healthy increases considering all the uncertainties and obstacles that distributors, vendors, and technology partners had to overcome during that time.

.

.Like Europe, revenue growth trends for North American countries’ followed their own paths. Strong 2021 sales results restored positive momentum in the U.S. Though increases were modest, revenue hit an all-time high in December at $6.9 billion (+7% over 2020) and a fourth-quarter record of $18.1 billion (+8 % over Q4 2020). The VAR channel gains were moderate in the second half of 2021, with Q3 revenue rising 1% and Q4 up 5%, while the smaller Dealer channel experienced 24% and 15% growth in the same periods.

Top Product Growth Categories in the U.S. for 2021

• Consumer electronics +44%

• Notebooks +23% following a 27% increase in 2020

• Cables/Adapters +15%

• AV +13%

• Power +12%

• Imaging +11%

Source: IDC North America Distribution Tracker, powered by GTDC

.

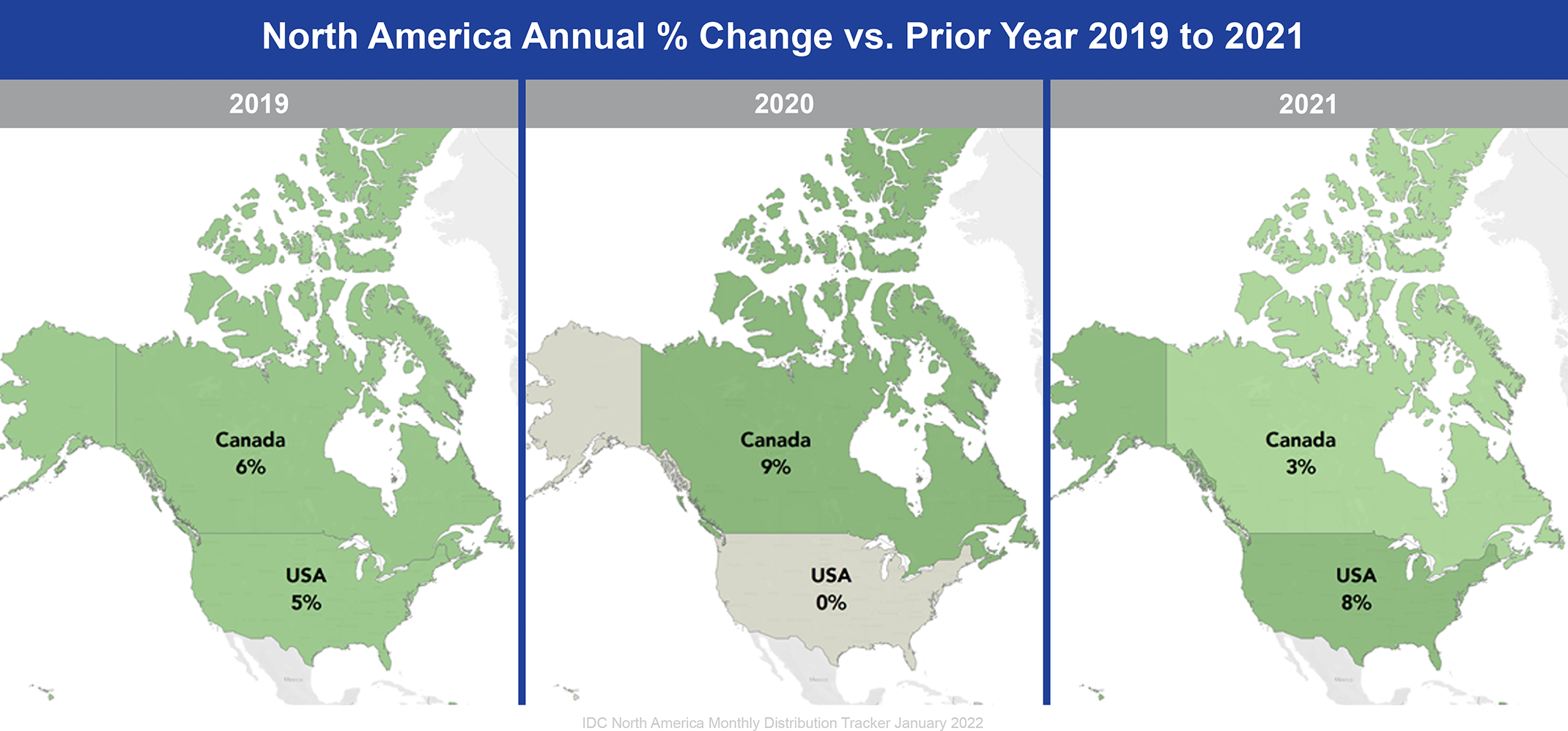

In 2019, both Canada and the USA grew between 5% and 6%. Since then those markets moved in opposite cycles based on annual sales results. In 2020 the U.S. remained relatively flat while Canada increased 9%, and in 2021, the northern market slowed to +3% and its southern neighbor grew +8%. In the two-year span, Canadian sales increased a combined 12% while the U.S. market rose 8%.

Top Product Growth Categories in Canada for 2021

• Components & Semi-Conductors +13%

• Power +12%

• Network Infrastructure +11%

• Consumer Electronics +11% following a 9% increase in 2020

• Notebooks +9% following a 40% increase in 2020

Source: IDC North America Distribution Tracker, powered by GTDC

COVID-19 restrictions and supply chain and chip shortage issues appear to be diminishing, and many IT businesses are resuming many of their “normal” activities. However, while some distribution and vendor executives are optimistic about sales and profitability prospects in 2022, others are taking a more cautious approach with their outlook. Lingering concerns around the pandemic and supply chain issues, and other global activities could soften consumer and business confidence and hinder growth projections.

Rising inflation and potential interest rate hikes could slow technology investments. At the same time, the escalating tension between Ukraine and Russia could disrupt the flow of goods and services and boost oil prices. The hope is that diplomacy can neutralize the latter threat, and global leaders will focus more effort on the other concerns now that the pandemic appears to be easing.

On the positive side, the continuing tightening of the job markets − with fewer people to fill skilled positions and labor costs skyrocketing – is driving the demand for technology even higher. With automation to boost business efficiency and productivity and tools that facilitate remote and hybrid work environments, the IT industry is poised to enjoy consistent long-term growth.

Stay current on the latest reports and industry insights with our Newsletter.

By entering your information you agree to receive marketing emails from the GTDC.